Early vs. Late Retirement Planning: A Comparative Analysis

The strategic timing of initiating retirement savings is essential for ensuring financial well-being in later life. This analysis contrasts the advantages of early savings with the potential drawbacks of postponing retirement contributions, offering a comprehensive view of how each choice influences retirement living standards.

Harnessing Compound Interest’s Potential

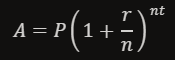

Embracing retirement savings at an early stage empowers savers to capitalize on compound interest’s potential. The compound interest equation,

illustrates that funds grow exponentially over time, with ( A ) representing the final amount, ( P ) the initial principal, ( r ) the annual rate, and ( t ) the duration of investment. Early savers benefit from a prolonged investment horizon, allowing a smaller initial investment to grow significantly due to the interest accruing over an extended period.

Freedom to Choose a Lifestyle

Commencing retirement savings early grants the flexibility to choose a preferred lifestyle in retirement. It enables retirees to engage in travel, pursue hobbies, and partake in leisure without financial limitations. A solid financial base provides retirees with a superior lifestyle quality and the assurance that they can manage their expenses and realize their aspirations.

Provision for Healthcare Needs

For retirees, healthcare expenses are a major financial concern. An early start in saving can guarantee adequate funds to manage escalating healthcare costs, which often consume a considerable portion of retirement funds. Sufficient savings also translate to better healthcare choices and reduced financial anxiety when addressing health issues.

Risks of Postponing Savings

Postponing the start of retirement savings introduces various risks, such as forfeiting the advantages of compound interest, necessitating a more intensive savings approach in later years, and potentially having to modify lifestyle aspirations or extend working years. Those who delay may also struggle with juggling several financial objectives at once, like funding children’s education, healthcare, and retirement.

Revising Retirement Expectations

Individuals who delay retirement planning may need to revise their retirement expectations. They might contemplate reducing living expenses, moving to more affordable locales, or maintaining some employment to augment retirement income. Such adjustments can markedly change the anticipated retirement lifestyle.

The Imperative of Immediate Action

Deciding when to commence retirement planning profoundly affects one’s future. Early planners reap the rewards of compound interest, enjoy financial autonomy, and secure a comfortable lifestyle, whereas late planners might confront financial hurdles and compromises. The crucial takeaway is to initiate retirement planning promptly to ensure a prosperous and satisfying retirement phase.

Very relatable blog

Thank you so much, we will keep up the good work.

With Gratitude,

Team Unpause Yourself